dc auto sales tax

Many vehicles are exempt from DC excise tax. Special reporting instructions for sales or leases of motor vehicles.

Are Car Repairs Tax Deductible H R Block

The Washington DC sales tax rate is 6 effective October 1 2013.

. Exact tax amount may vary for different items. The cigarette surtax will be 36 for a package of 20 cigarettes. Thorough research of the vehicle you are considering purchasing including vehicle registration and title histories can be obtained from several companies such as Carfax.

Office of Tax and Revenue. The District of Columbia state sales tax rate is 575 and the average DC sales tax after local. The Office of Tax and Revenue OTR reminds taxpayers of services that will be required to collect the Districts 575 percent Sales and Use tax effective October 1 2014.

As a result of recent regulatory changes DC DMV has revised the calculations for motor vehicle excise taxes. Spirituous or malt liquors beers and wine sold for off-premises consumption by certain the Alcoholic Beverage Control Board licensed vendors are. Title 50 Chapter 22.

Motor vehicles with fuel economy in excess of 40 mpg including EVs are eligible for an exemption for paying the. Additional information about the various components which make up the registration and title. The District offers a tax exemption for EVs and high efficiency vehicles.

2022 District of Columbia state sales tax. 1101 4th Street SW Suite 270 West Washington DC 20024. Effective July 1 2003 all retail sales leases and transfers of motor vehicles are subject to the additional sales tax or use tax of three-tenths of.

A tax rate of 7 is charged if the vehicle weighs between 3500 and 4999 pounds and 8 is charged for vehicles that weigh at least 5000 pounds. Sales and Use Taxes. Based on manufacturers shipping.

For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am to 530 pm Monday. Use tax is imposed at the same rate as the sales tax. Title 47 Chapters 20 and 22.

Review our excise tax exemption list Rates are. Masks are still required at DC. What is the motor vehicle salesuse tax.

Motor Vehicle Excise Tax. In lieu of sales tax collected by vendors there now will be a cigarette surtax levied on cigarettes sold. Do not use the sales tax forms to report and pay the gross receipts tax.

How to buy and sell a vehicle in the District. The supported browsers are Google Chrome Mozilla Firefox Microsoft Edge and Apple Safari. 1101 4th Street SW Suite 270 West Washington DC 20024 Phone.

This is a single district-wide general sales tax rate that applies to tangible personal. Please press Enter to open the search input box and press tab to start writing to search somthing. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees.

DC DMV Service Update. The updated excise tax rates will take into account the fuel efficiency of motor vehicles as mandated by Title V of the CleanEnergy DC Omnibus amendment Act of 2018. Walk-in service has returned to DC DMV for all Service Centers and Adjudication Services.

You are now at the search section. The browser you are using is not supported for the DC DMV Online Services. Information on the excise tax for DC titles can be found at DC Official Code 50-220103.

For more information visit the FAQ page. The District of Columbia collects a 6 state sales tax rate on the purchase of all vehicles that weigh under 3499 pounds. The motor vehicle saleslease tax also applies when use tax is due on demonstration executive and service vehicles.

Current Tax Rates The rate structure for sales and use tax that is presently in effect. Monday to Friday 9 am to 4 pm except District holidays. Issuance of every original and subsequent certificate of title on motor vehicles and trailers.

Connect With Us 1350 Pennsylvania Avenue NW Suite 203 Washington DC 20004 Phone.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

States With No Sales Tax On Cars

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Virginia Sales Tax On Cars Everything You Need To Know

Which U S States Charge Property Taxes For Cars Mansion Global

Nj Car Sales Tax Everything You Need To Know

My Vehicle Title What Does A Car Title Look Like

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax On Cars And Vehicles In District Of Columbia

What States Charge The Least Most In Car Taxes Carvana Blog

Dc Motors Used Cars Northwood Oh Used Bhph Cars Oregon Oh Bad Credit Car Dealer Northwood Oh Pre Owned Bhph Autos Oregon Oh Previously Owned Vehicles Northwood Oh Used Suvs Oregon Oh Used Bhph Trucks Northwood Oh Used

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

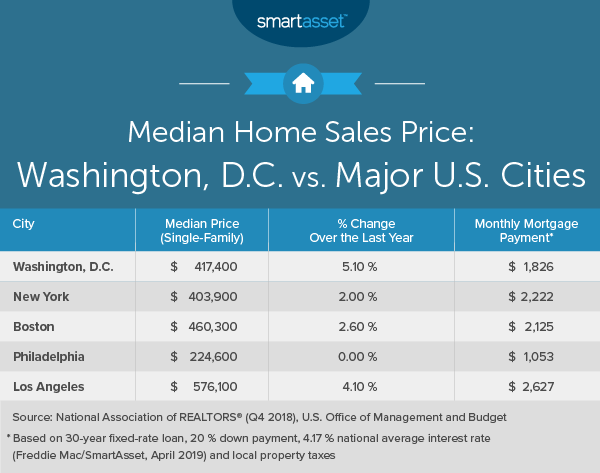

The Cost Of Living In Washington D C Smartasset